Diamond Prices – Rapaport Diamond Report

In order to understand diamond prices you’ll need to first understand how diamonds are valued. Despite the fact that every diamond is unique, we have attempted to categorize and assign value to common diamond characteristics in order to adhere to a universal pricing system.

In order to understand diamond prices you’ll need to first understand how diamonds are valued. Despite the fact that every diamond is unique, we have attempted to categorize and assign value to common diamond characteristics in order to adhere to a universal pricing system.

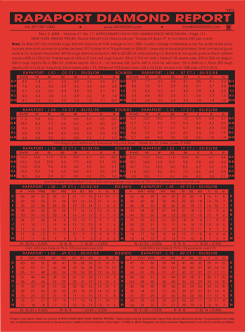

One of the first pioneers who attempted to establish a workable system of diamond characteristics and pricing is Martin R. Rapaport.

The Rapaport Group was established in 1976 by Martin Rapaport and is best known for their electronic trading network; RapNet which stands as the world’s largest diamond trading network for professionals within the diamond industry.

The Rapaport price list is a weekly published diamond price chart offered to subscribers with a trade account. Diamond manufacturers, dealers and retailers refer to this diamond price list as a guide for their diamond buying and selling practices.

The Rapaport diamond prices are reliant upon gem lab reports evaluation of common diamond characteristics including carat weight, color, and clarity. According to the Rapaport trading network, AGS Lab graded diamonds trade the highest in price with GIA coming in 2nd and HRD coming in 3rd.

How Diamonds Are Priced – Carat Weight Is The Major Factor

Martin Rapaport and Liz Hancock

Diamonds are priced per carat as well as color and clarity characteristics. The value of each diamond increase exponentially as the carat weight increases along with the pertaining carat weight category. Carat weight categories include .50ct, .70, 1.00, 1.50, 2.00, 3.00, and 5.00 where diamond prices tend to jump significantly. Thus, a .95ct diamond will cost significantly less than a 1.00ct diamond, though they weigh nearly the same in carat weight.

Color and clarity are also significant factors to diamond prices which are again dependent on the gem lab that evaluated the diamond in the first place. Clarity grades of SI1 or SI2 carry a wider range of clarity possibilities and ratios with some diamonds being eye-clean, whereas others are obviously flawed. As the clarity grade increases, the allowance for inclusions and blemishes is significantly less and therefore diamond prices significantly increase with higher clarity grades.

Diamond cut grade is not found in most lab reports with the exception of AGS and GIA (round brilliants only) and therefore the Rap list does not cover this characteristic in its diamond price list. Diamond wholesalers, dealers and retailers will have to take each individual diamond into consideration and evaluate its cut proportions in order to add a premium to the rap list price or offer a discount.

It is simply impossible to determine an accurate value of ANY diamond based upon the Rap list without knowing the cut quality of the diamond. This being the case even though we know the carat weight, color and clarity grades. That is how important diamond cut is in the marketplace.

IDEX Diamond Price Report

In 2004, International Diamond Exchange, aka IDEX established their own price list. The IDEX Diamond Price Report is published weekly and is an analysis of asking prices for higher-quality diamonds in the international wholesale markets. Their report is based on price changes as reflected by the global trade on their platform which is the first and oldest index based on actual listing data (this provides reliable, transparent, and unbiased pricing information).

Why We Value Diamonds And Invest In Them

Diamonds hold their value as a gem material due to:

- Beauty – High adamantine luster which is extremely bright and reflective; high dispersion also known as ‘fire’

- Durability – hardest natural material (resists abrasion); Toughness (resist the development of fracture/cleavage), Stability (resist physical/chemical alteration due to light, heat or chemical attack)

- Rarity – Approx 250 tons of rough ore mined yields a single carat of gem grade diamond (.2 grams); approximately 80% of mined diamonds are industrial grade diamonds and not suitable for jewelry.

- Acceptability – Current marketing has reinforced the first 3 values as highly desirable and a cultural expectation

Ultimately, diamonds are desired for the way they make the individual ‘feel’. It is an emotional purchase like so many other things in life; fine wine, luxury vacations, exotic cars, one-of-a-kind perfumes, couture fashion, hand-made shoes, rare watches, distinct property, etc.

Building off of the above value as a gem material, investors and collectors look for unique, unusual and rare qualities to further their investment profit including:

- Rarity by way of unusually large diamonds

- Unusually high color grades

- Unusually high clarity grades

- Unusually precise cut precision

- and extremely rare fancy colors

As mentioned above, diamonds that are rare in carat weight, color, clarity, and cut grade all help boost the inherent value and investment potential. However a lesser known option are fancy colored diamonds.

Fancy Colored Diamond Prices and Long Term Investment

As described by Leibish&Co, “During the last 15-20 years, fancy colored diamonds have shown an accelerated increase in valuation both per carat price and total overall price paid. This is due to increase in awareness by investors of the rarity of such a natural resource, and its superiority in wealth concentration.”

As described by Leibish&Co, “During the last 15-20 years, fancy colored diamonds have shown an accelerated increase in valuation both per carat price and total overall price paid. This is due to increase in awareness by investors of the rarity of such a natural resource, and its superiority in wealth concentration.”

Thus, an individual looking to invest in a fancy colored diamond could choose to:

1. Invest in shares of the major mining companies

2. Buy individual fancy colored diamonds

3. Invest in a diamond fund

For more information on investing in fancy colored diamonds, I recommend Leibish&Co’s Diamond Investment E-book.

White diamonds on the other hand have a very low resale value and in most circumstances a diamond ring is worth the wholesale price of your diamond plus whatever precious metal your diamond is set in. If you’d like more information on how to sell your white diamond jewelry, please read ‘Do You Need To Sell Your Diamond Jewelry?‘

Ultimately, all things are valued based on need or desirability. The supply of gem quality diamonds coupled with their high demand has made the diamond a desirable material for adornment and decoration and a symbol of prestige, wealth, and class. Although diamond prices fluctuate according to supply and demand, the actual purchasing of a diamond will always come down to how the individual feels whether they’ll be wearing it, showcasing it, or banking on it for a rainy day.

Please contact me should you like more information on diamond prices online and diamond recommendations. If you are thinking of investing in a diamond I am also able to guide you in this process. I look forward to hearing from you.

Happy Diamond Buying!

ODBA Recommends

You May Also Like